|

Estate Planning

Newsweek

Publication Noting Steve and Bonnie Kaufmann the

founder of A Better Choice Foundations - as educators practicing in

Virginia to help people protect their assets.

"Are

You Covered"

"A Plan for Life"

"Start Thinking Long-Term"

"Home Security"

Printed, April 27th, 1998

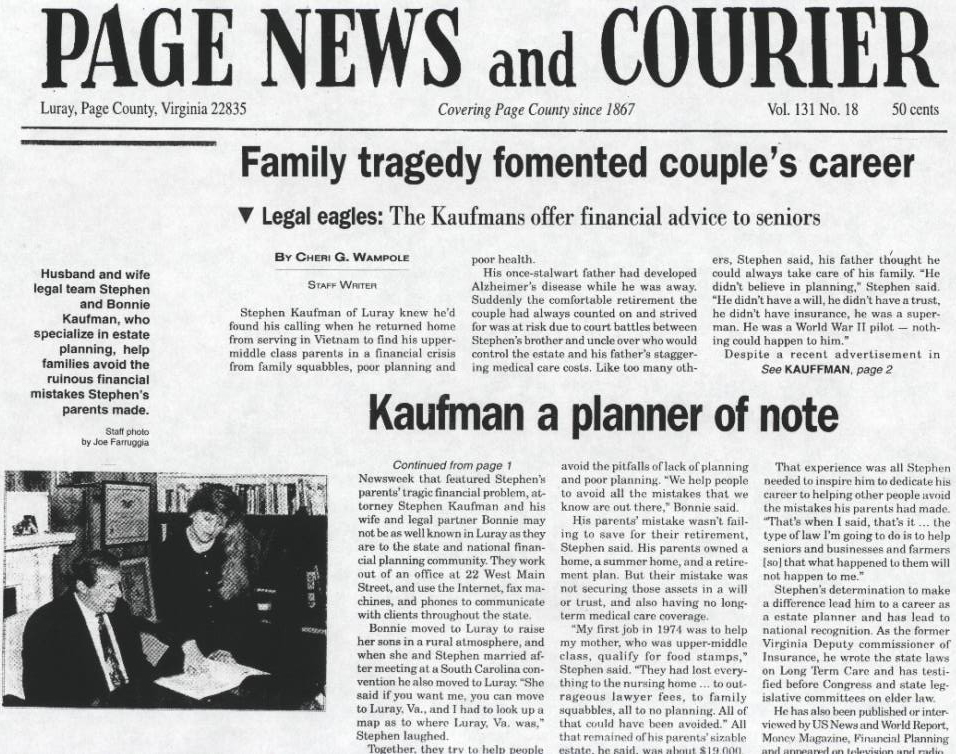

When Steve Kaufmann went to

serve in Vietnam, he left behind happy, prosperous and healthy parents.

Upon his return, he discovered the once sturdy couple, who had been

looking forward to a comfortable retirement, had been devastated by

Illness, economic adversity and a bleak future. While Steve was away,

his father had been stricken with Alzheimer’s disease, and the family’s

home and summer cottage were lost to foreclosure. His mother was left

with a life of heartache and financial ruin. His parents had never

purchased health or life insurance, and they didn’t have a will. *

Years later, Steve recalls

the painful memory of watching helplessly as his family fell apart.

Those same memories have shaped his resolve to help people prepare for

the unexpected. As a successful attorney in Luray, VA., and member of

the American Society of Chartered Life Underwriters (CLU) &

Chartered Life Financial Consultant (ChFC), Steve travels the nation

with his wife and legal partner, Founder. Their mission: To help

families protect their, assets from the devastation of illness,

disability and sudden death.

Steve Kaufmann’s family

experience, though tragic, is not unusual. Far too many American

families work hard to accumulate assets and plan for a comfortable

retirement, only to see their efforts unravel in years later. While

most people see the need to buy insurance coverage for their home, car

and health, they don’t view coverage that protects their income and

livelihood as a necessity. This special section takes a look at these

important issues and provides helpful information about protecting your

financial security in years ahead.

“Think of life insurance as a

plan for your life, not your death, ”says David Woods, CLU, ChFC,

president of the Life and Health Insurance Foundation for Education

(LIFE) in Washington, D.C. Along with disability income coverage, life

insurance is the cornerstone of a sound financial plan. So, be sure you

have enough coverage t protect your family and/or business from

financial ruin- before you begin to save an invest for the future.

More than half of Americans

are underinsured, and 24 percent of all households have no life

insurance, according to the American Council of Life Insurance.

Who are America's

underinsured? Predominantly, they're women married working women,

single working mothers and women who stay at home to care for children.

In 1997, men accounted for 63 percent of the new life insurance

policies compared to just 37 percent for women. Moreover, the average

size policy for a man was $306,900 versus $165,00 for a women for a

woman, reports LIMRA International, an insurance marketing and research

association in Windsor, Conn.

Demystifying Life Insurance

The wide variety of life

insurance products available today can be confusing and may even

prevent some people from buying the protection they need. The two most

frequently asked life insurance questions are: How much coverage do I

need? And, what type of policy best meets this need?

“To help you select the best

life insurance policy for your family’s financial needs, work with a

professional life insurance agent,” advises Edward H. Miller, III, CLU,

ChFC of Indianapolis, Ind., president of the American Society of CLU

& ChFC. “An agent will carefully and thoroughly review your

financial situation, goals and objectives. An agent should also review

your insurance coverage periodically, and certainly as your

circumstances change, such as with a child’s birth, divorce, remarriage

or job change.”

How much coverage you need

depends on why you’re buying insurance—or continuing to pay premiums

for a policy you already own. For most people, life insurance's primary

purpose is to make sure there's enough income for the family in the

event of a wage earner’s premature death. Other practical uses for life

insurance include paying debts and estate taxes, funding a child’s

college education or supplementing other retirement income sources.

Insurance Illustrations

To assist consumers in

selecting the life insurance policy that meets their individual needs,

insurance companies have developed policy illustrations that are

estimates of future policy performance. Illustrations are used with

life insurance policies that provide cash value, such as whole life,

variable life and variable universal life. Agents use these

illustrations to develop the best combination of policy specifications

that achieve their clients’ financial objectives. If properly

interpreted, life insurance illustrations contain useful information

about how the insurance policy is expected to perform in years to come.

An insurance illustration is not a legal contract, but it’s merely an

estimate of future policy performance. There are three main elements in

an insurance illustration:

• Guaranteed, called

“guaranteed basis” or “guaranteed cash and surrender values.’ Pay

attention to these values because they represent the worst-case

scenario. The insurance company is contractually obligated to make sure

your policy performs at the guaranteed level. Be aware: Some insurance

companies provide better guarantees than others.

• Non-guaranteed or current

interest.

This is the interest rate the company is currently paying on this

particular policy. Midpoint rate, also called the “illustrated rate” or

“non-guaranteed rate.” This rate of return falls in the middle between

the company’s worst-case scenario that’s guaranteed and the

non-guaranteed current interest rate, which will fluctuate.

A policy’s performance also is based on the following non-guaranteed

risk elements: mortality experience, which is based on statistical

tables; investment performance earned by the insurance company; policy

lapse rates, or the number of policyholders who drop their insurance;

and company expenses, which include the cost of keeping the policy in

effect. Insurance illustrations should not be used to compare two or

more life insurance policies.

Variable Life and Variable

Universal Life

If you are willing to assume

more risk in return for earning higher interest, says Joseph Ramenda,

JD, CPA CLU, ChFC, of Tampa, Fla., you may be in the market for

variable life or variable universal life insurance. Both these policy

types build cash value over the years. Here’s how they work. Variable

life insurance not only provides all the benefits of its traditional

counterpart, whole life insurance, but also offers an investment

component. As with whole life, variable life gives you the tax-deferred

build-up of the policy’s cash value, as well as an income tax-free

death benefit for your family. As an added benefit, a variable policy

allows you to select where your premium dollars are invested. The

insurance company has separate investment accounts with varying rates

of return,* Some variable policies guarantee that death benefits cannot

fall below a certain minimum, but investment performance will raise and

lower the policy’s cash value and benefits. In addition, you may add a

policy provision or rider that gives the option to purchase more

insurance without a medical exam or evidence of insurability. Variable

universal life (VUL) policies combine the best features of several

different policy types, according to Ben Baldwin, CLU, ChFC, CFP, of

North-brook,111. With a VUL policy you get: (1)the death-benefit value

of term insurance; (2) flexible premium payments that fluctuate

according to market conditions and are subject to certain minimums and

maximums; and (3) investment-account flexibility of variable life. Be

sure to keep putting enough money into the policy so it doesn’t lapse.

Should / Replace an Existing Life Insurance Policy? Policy replacement

may sound attractive as a way to save money on the life insurance

coverage you already have or to get more coverage for what you’re

already paying, And while sometimes it may be to your advantage, most

of the time it isn’t.

Term insurance and long-term

care insurance are two types of insurance policies issued by life

insurance companies that can sometimes be improved. However, when

replacing a policy, watch out for important “incontestability”

provisions that you may lose for as long as two years with a new

policy.

If your agent suggests

replacement coverage, ask the agent to complete the American Society of

CLU & ChFC’s Replacement Questionnaire (RQ). For a free copy, call

toll-free1-888-243-2258. Have the agent review the RQ responses with

you, and ask for clarification if something doesn’t make sense.

“President Clinton’s proposed

1999 budget includes a tax provision affecting variable life insurance

and variable annuities. For more information, consult your insurance

and tax professionals

Income Objective Chart

How much would your family

need? Th e following are typical income objectives taht may permit a

family to retain their current lifestyle after a wage earner’s death. *

Assumptions: The home mortgage is paid or a rent fund has been

establisheed, and educational expenses are provvided for separately.

Annul Gross Income Percentage of Gross Income required Up to $48,000

70%

$48,001 to $53,000 66%

$53,001 ro $59,000 63%

$59,001 to $65,000 60%

Over $65,000 57%

* Bases on a study by the

Bureau of Labor Statistics

For a free insurance needs

worksheet, visit the American Society of CLU & ChFC’s Web site:

Http://www.asclu.org Or write to: Life insurance Needs Worksheet,

American Society of CLU & ChFC, 270 S. Bryn Mawr Ave., Bryn Mawr,

PA 19010 - 2195

A Plan for Ljfe cont’d

Other Considerations

• If your health status has changed over the years, you may no longer

be insurable at the less expensive, standard rates.

• Your present policy will

usually have a lower premium rate than is required on a new policy of

the same type—if for no other reason than you have grown older,

• You’ll pay acquisition

costs on two policies and end up owning only one.

• Even if both policies pay

“dividends,” it may be years before the new policy’s dividends equal

those of your present policy,

• If you replace one cash

value policy with another, the new policy’s cash value may be

relatively small for several years and may never be as large as that of

the original one. You should ask insurance agents for a detailed

listing of cost breakdowns of both policies, including premiums, cash

surrender value and death benefits. Compare these as well as the

features offered by both policies.

• If you decide to surrender

or reduce the value of the policy you now own and replace it with other

insurance, be sure that (a) the agent making the proposal puts it in

writing; (b) you pass any required medical examination; and (c) your

new policy is in force before you cancel the old one.

Paycheck Protection

Gary Smith, CLU, ChFC, of

Syracuse, N.Y., has seen the same scenario played out many times. As a

financial adviser, he’s heard clients tell him that buying disability

income (Dl) insurance is a waste of money. Clients often rationalize:

“I’m healthy, I feel fine, I don’t need to spend the money.” One of

Smith’s clients, Tony, a successful realtor, applied this same logic,

but reluctantly purchased an individual Dl policy anyway. A few winters

ago, Tony began power walking to lose some weight. He slipped and fell

on a patch of ice, shattering his knee cap. His ability to work was

severely limited and his recovery was slow and painful. When Tony

called Gary Smith from the hospital the day after his emergency knee

surgery, both men were relieved, knowing they had done the right thing.

Tony’s Dl coverage provided $3,000 per month tax free, replacing his

lost income. The coverage helped him focus on getting well, not on his

finances.

The chances of suffering a

disability— an illness or injury lasting more than three months—are

three times greater than dying before age 65, according to Edward H.

Miller, Ill, CLU, ChFC, the American Society’s president. Consider

this: If you earn an income, you need Dl coverage. This type of

insurance is paycheck protection in case you suffer an injury or

illness that prevents you from working.

Many employers provide some

group disability coverage, but it’s typically not enough to cover

current living expenses. While Social Security might pay something,

it’s prudent to buy an individual Dl policy that pays 70 percent of

your current income.

Disability income insurance is paycheck protection in case you suffer

an injury or illness that prevents you from working.

Helpful Answers to

Some Common Questions

Q: What’s the difference

between whole life, term, and convertible term insurance?

A: Whole life insurance, the

most traditional form of insurance, can be kept in force for as long as

you live. The face amount (the death benefit) and the premium (the

amount you pay for protection each year) are fixed at the time you buy

your policy and stay the same even as you age. The policy’s “cash

value” grows at a fixed rate of return specified ’in the policy and can

be used as collateral to borrow against your policy. While permanent

insurance is usually recommended as the core of an insurance program,

term insurance is good for people who need coverage for short periods

of time—younger families, say, who need large amounts of protection for

one year, five years or more. Lower premiums at younger ages increase

as policyholders age and renew their policies. Benefits are paid only

if death occurs during the period covered. If you stop paying premiums,

the insurance stops. Term policies generally have no cash value and no

residual rights if the policy is canceled. “Convertible” term policies

can be exchanged for permanent insurance without a medical examination,

but with a higher premium.

Q: By using medical tests are

insurers trying to eliminate any applicant likely to develop a serious

health condition?

A: Because some health

conditions are easily managed through proper medication, therapy or

lifestyle changes, medical information sometimes makes it possible for

insurers to cover applicants who might not otherwise be insurable.

Overall, only 4 percent of individual life insurance applications are

declined.

Q:As a single person, do I

need insurance?

A: As a single wage person,

you need to consider these options:(1) Disability income

insurance—Especially Important for self-supporting singles without

sizable assets, this can replace a good part of the income you would

lose if you were unable to work because of accident or illness. If you

don’t have long-term disability coverage at work, ask your life

insurance agent about an individual policy designed to replace at

least70 percent of your income. (2) Health insurance—If you don’t have

on-the-job coverage, an individual policy is your first line of defense

against ever-escalating medical and hospital costs. You can keep

premium costs down by electing a large deductible, thereby

“self-insuring” as much as you can afford. (3) Life insurance—Even if

you have no dependents now, you may later. If you buy now when you are

younger and healthier, you can “lock in” lowest-cost coverage,

including guaranteed insurability.

Q. How do variable and fixed

annuities work?*

A: Annuities are long-term

investments that provide • retirement income to individuals without

pensions, that supplement a pensioner’s income or build assets over a

more limited period. With variable annuities, the value varies

according to the worth of the insurer’s investments, such as bonds and

common stock. Payments can be fixed or build assets over a more limited

period. Under a fixed annuity (also called a fixed-dollar annuity),

money is invested in assets with fixed rates of return and the owner is

guaranteed a fixed payment every month. Because annuities are designed

to be held for many years, the interest in an annuity builds up on a

tax-deferred basis, and purchasers are not taxed until regular payments

begin after retirement. Early withdrawals, however, result in

substantial penalties in addition to federal taxes.

Q: How do accelerated death

benefits work?

A: More than 200 insurers now

offer this “living benefits” option to ease the financial burdens of

the seriously ill or incapacitated. It allows policyholders to receive

all Or part of the policy’s proceeds prior to death under certain

circumstances, including the need for long-term care and confinement to

a nursing home. Because payments may affect tax status and Medicare

eligibility, and will be deducted from the overall benefits paid later

to beneficiaries, policyholders should thoroughly investigate these

options prior to needing them.

Source: National Association

of Life Underwriters, Washington, D.C.

*President Clinton’s proposed 1999 budget includes a tax provisions

affecting variable life insurance and variable annuities. For more in

formation, consult your insurance and tax professional Start Thinking

LONG-TERM.

Nearly 43 percent of American

who are currently age 65 and older will enter a nursing home, according

to the U.S. Department of Health. and Human Services. If you are a

woman, your chance of entering a nursing home after age 65 is 50

percent greater than a man’s.

Consider this fact: About one

out of every four Americans will stay in a nursing home for more than a

year, and one in 10 will stay five years or longer. And, long-term-care

costs continue to rise at about 6 percent a year. A year in a nursing

home is estimated to cost $46,000, according to the American Society of

OLU & ChFC. In large metropolitan areas, the cost can easily be

double this amount.

Caring for a parent or other

relative at home is also costly, averaging more than $1 000 per month.

A prolonged illness or the daily effects of Alzheimer’s disease, stroke

and even arthritis could cause a lifetime of savings to disappear.

Long-term care (LTC) insurance protects your assets during your

retirement years, just as disability insurance protects your income

during your working years. Don’t fall prey to this common

misconception: You don’t have to worry about long term care costs

because Medicare will pick up the tab. Wrong. Generally, neither

Medicare, private Medicare supplement insurance, nor the major medical

insurance you have on your own or though your employer will pay for

long-term care.

Medicaid, for those who

qualify, will pay for long-term care expenses, but only in

Medicaid-approved facilities. Medicaid, which is administered by your

state, requires its recipients to be impoverished; it’s a safety net

for the poor. Families that used to manipulate finances or “spend down”

assets in order to qualify their aged parents for Medicaid benefits are

now barred from doing so. Criminal sanctions may even be imposed on

those who attempt to transfer property to qualify, according to the

Journal of the Amer/dan Society of CLU & ChFC.

It’s less expensive to buy a

long-term care policy when you are younger, say before age 50 or 60.

How Not to Outlive Your Retirement Savings. With more people living

well into their 80s and 90s these days, it’s no surprise that a common

financial goal is not outliving savings and investments during

retirement. Another major concern is the exorbitant long-term care

expenses associated with aging. Many baby boomer families already find

themselves uncomfortably “sandwiched” between the demanding health.

Are You Covered?

• Ask your agent if the

policy is “qualified” under the Health and Portability and

Accountability Act of 1996. In order for LTC premiums and benefits to

be tax deductible, the policy must be “qualified” under the law.

• custodial and home health

care?

• What are the set of

conditions, called “benefit triggers,” under which the insured will be

eligible f or benefits? Most policies do not require hospitalization

prior to entering a nursing home.

• Does the policy explicitly

cover Alzheimer’s disease and other senile dementia?

• What protection does the

policy offer against the effects of inflation?

• What is the duration of

policy benefits—from two to six years or a lifetime benefit for nursing

home care?

• What is the policy’s

elimination or waiting period before benefits begin?

• Selecting a longer waiting

period will lower your premiums.

• Does the policy adequately

cover the cost of long-term care where you live? LTC costs vary

depending on geographic location.

• What is the term of the

policy’s preexisting clause? There should be no more than a six-month

exclusion for a preexisting condition.

Care, emotional and financial

needs of their children and their aging parents.

Recognizing the unique

retirement planning needs of an aging population, the insurance

industry developed a product, called an annuity, which can have either

a fixed or variable rate. Annuities offer investors both a death

benefit and the ability to accumulate money for retirement, with taxes

deferred until the money is withdrawn. Unlike insurance, which is a

hedge against dying too soon, annuities are designed to provide

investors with a lifetime income stream. Unlike fixed annuities, which

pay regular amounts, the value of variable annuities fluctuates. A

variable annuity allows you to put money in a variety of investment

vehicles (sub-accounts), including stocks and bonds or a combination

thereof. Variable annuities give you the option to move among the

sub-accounts in the contract you buy.*

With both fixed and variable

annuities, withdrawals prior to age 59 ½ may incur a 10 percent

IRS penalty.

While it’s true that some expenses will decrease during retirement,

perhaps even your tax rate, higher medical costs could offset these

estimated savings. Expect to tap monies from employer-sponsored

retirement plans and personal savings for as much as 85 percent of your

total retirement income. Social Security, most experts predict, may

provide only 15 percent to 25 percent of retirement income, if that.

Leave More to Heirs, Less to

Uncle Sam

In the next 15 to 20 years,

more than 30 million seniors will be looking for ways to pass a

combined generational estate of $10 trillion to the next generation—the

77 million baby boomers. “As we approach the 21st century, the

importance of estate planning and asset protection has never been

greater,” says Stephen J. Kaufmann, JD, CLU, ChFC, QPCU, of A Better

Choice Law, Retirement and Estate Planning, in Luray, Va.

Today, it is almost

commonplace for seniors’ assets to surpass the $625,000 estate tax

threshold through lRAs, rising home values and conservative but

consistent savings, according to Kaufmann. “It’s a sad fact of life

that one-third to 100 percent of assets that took decades to accumulate

can be lost quickly when little or no estate planning has been done.”

Some significant reasons why estates erode include: federal estate

taxes, which can reach as high as 60 percent; probate costs; attorney’s

fees; long-term care expenses; and improper ownership of assets.

The government tried to ease

the burden by gradually increasing the federal estate tax threshold

from $625000 in 1998 to $650,000 in 1999, to $675,000 in 2000, and so

on, until 2006 when it will reach $1 million. The ravages of inflation

on your estate, however, could more than offset this relatively minor

tax relief.

*President Clinton’s proposed

1999 budget includes a tax provision affecting variable life insurance

and variable annuities. Consult your insurance and tax professionals.

One of the more important

considerations when buying long-term care insurance is the insurance

company’s financial strength. Policies also have a variety of

contractual definitions that may expand or limit your coverage. Here’s

a checklist to help you select a LTC policy: Property and casualty

insurance offers consumers protection from financial losses caused by

damage to personal and business property, as well as legal liabilities

from property damage or personal injury for which an insured is

responsible.

“When it comes to buying

insurance, the best consumer is an informed consumer,” says Marsha D.

Egan, CPCU, CPIW, of Reading, Pa., and vice president of the CPCU

Society. “As a policyholder, your behavior patterns and actions can

help directly control insurance costs.”

To be sure that you have the

right amount and types of homeowner’s coverage, consider these tips

from the QPCU Society: Establish the value and calculate the cost of

rebuilding your home. What you paid for your home or what you could

sell it for in today’s market can differ substantially from what it

would cost to replace it. Some companies offer a guaranteed replacement

cost coverage option that will pay you what it costs to rebuild your

house at the time of a loss. There is usually an additional premium

charge with this option. Be sure to have replacement cost coverage on

your b~Iongings, such as furniture and clothing. A typical homeowner’s

policy insures contents at actual cash value, which reflects physical

article depreciation just prior to the loss. An inflation guard

endorsement will automatically increase your coverage as the value of

your home increases.

The homeowners’ policy

contains limitations on certain types of high-valued items such as

jewelry, fine arts, stamp

Are You Covered?

collections, furs and

precious metals. These items should be separately scheduled on Personal

Articles Floaters. If you make significant home improvements, such as

an addition, or incorporate special architectural features after you

purchase your policy, notify your agent or broker in order to increase

your property limits.

Maintain an up-to-date inventory of your belongings. Keep the inventory

or a copy of it in a safe location. Video cameras are excellent tools

for documenting your belongings.

If you work out of your home,

be aware that the typical homeowner’s insurance policy does not cover

business contents or liabilities.

Flood Insurance

Standard homeowners’ insurance does not cover flood damage. Flood

insurance policies are available to cover these risks for homeowners,

renters and businesses. When you purchase flood insurance there is a

30-day waiting period before coverage goes into effect. If you think

you have a flood exposure where you live, contact your insurance agent

or broker. To find out more about flood insurance, visit the Federal

Emergency 14 Management Agency’s (FEMA) Web site at:

http:/A~w.fema.gov.

For a free consumer education

brochure about property and casualty insurance, contact the CPCU

Society at 1 -800-932-2728. Or, visit its Web site:www.cpcusociety.org.

Peace of Mind

Life is hectic enough these days. You work hard and your time is

valuable, Taking time to review your family’s insurance needs—before

something happens—is time well spent. For help, consult an insurance

and financial services professional. After all, you and your family

deserve the peace of mind proper insurance coverage provides.

This special section is

sponsored as a public service by the American Society of CLU &

ChFC, a national organization of llfe insurance and financial service

professionals headquartered in Bryn Mawr, Pa. The Society’s 33,000

members are dedicated to providing financial security for individuals,

families and business.

Written by Susan J. Farmer;

Technical consulting by Richard M. Weber, CLU.

Product Information Guide

To receive the latest

information from these Newsweek advertisers, simply dial their

toll-free numbers or visit their Internet addresses.

ALLSTATE 1-888-ALLSTATE

http://www.ALLSTATE.com

CONSECO 1-888-9-CONSECO http://www.conseco.com

DELOITTE & TOUCHE CONSULTING http://www.dtcg.com

FEMA 1-888-CALL-FLOOD x760 http://www.fema.gov/nfip

LIFE 1-800-268-7680

http://www.life-line.org

STATE FARM http:www.statefarm.com

For a print of this article,

call 1 800 326 4179.

|